Pismo is a cutting-edge digital platform that redefines how businesses manage their operations, communications, and content workflows.

By seamlessly integrating automation, document management, and team collaboration tools, Pismo provides a comprehensive solution designed to enhance productivity and streamline complex processes.

Whether it’s automating repetitive tasks, organizing documents, or improving communication within teams and with clients, Pismo offers an intuitive and secure environment to drive business efficiency. Ideal for organizations of all sizes, this versatile platform empowers businesses to work smarter, not harder, while maintaining compliance and security at every step.

What is Pismo?

Pismo is an innovative, all-in-one platform designed to transform the way businesses manage their digital content, workflows, and communications.

With an emphasis on automation and ease of use, Pismo offers a suite of tools that streamline business processes, enhance collaboration, and simplify the management of internal and external communications.

At its core, Pismo focuses on helping organizations automate repetitive tasks, manage documents, and facilitate communication between teams and clients.

The platform’s features include document management systems, workflow automation, communication tools, and customizable dashboards. These capabilities allow businesses to maintain a high level of productivity while ensuring that all stakeholders are aligned and informed.

Demo Video

Dashboard Overview Images

Key Features

1. Core Banking Infrastructure

Pismo offers a comprehensive suite of banking services, including demand deposit accounts (DDAs), savings, overdrafts, and interest-bearing accounts. Its microservices architecture enables banks to model complex organizational structures and manage multi-country, multi-region operations with ease. The platform supports both retail and corporate banking needs, facilitating smooth migrations from legacy systems to modern, cloud-based solutions.

2. Card Issuing & Payment Processing

With Pismo, institutions can issue credit, debit, prepaid, and virtual cards, integrating seamlessly with major networks like Visa and Mastercard. The platform supports instant card issuance, EMV and contactless transactions, and dynamic CVV for enhanced security. Developers can leverage Pismo’s extensive RESTful API library to customize and manage the entire card lifecycle, from issuance to transaction processing.

3. Digital Wallets & Payments

Pismo enables the creation of proprietary digital wallets compatible with QR codes, NFC, Apple Pay, and Google Pay. These wallets support tokenization, peer-to-peer transfers, merchant payments, and rewards programs, all within a secure and scalable environment.

4. Seller Management & Marketplace Solutions

The platform provides robust tools for managing sellers, including flexible settlement schedules, split payments, and customizable fee structures. It supports both on-us and off-us transactions, catering to various business models such as online marketplaces, e-commerce facilitators, and in-store sales.

5. Digital Lending Capabilities

Pismo facilitates the development and management of digital lending products, encompassing loan booking, disbursement, auto-repayment, and product return handling. Its scalable architecture allows for the rapid deployment of innovative loan offerings, meeting diverse customer needs.

6. Compliance & Security

Built with a focus on security, Pismo complies with industry standards such as PCI-DSS, ISO 27001, and SOC II. The platform’s high-availability infrastructure ensures 24/7 operations with zero downtime, supporting over 75,000 transaction authorizations per second.

7. Developer-Friendly APIs

Pismo offers an extensive set of APIs, enabling developers to build and integrate financial services efficiently. The platform provides comprehensive guides, sample code, and a sandbox environment to facilitate seamless development and testing.

Use Cases

Digital Banking Transformation

Pismo is ideal for financial institutions seeking to modernize their operations. By migrating from legacy banking systems to Pismo’s cloud-native platform, banks can streamline their services, enhance customer experiences, and innovate with real-time processing capabilities. Whether it’s providing digital checking and savings accounts or offering advanced fraud detection tools, Pismo enables financial institutions to deliver next-gen banking services efficiently.

Card Issuance and Payment Solutions

For businesses or fintech companies looking to issue credit, debit, prepaid, or virtual cards, Pismo offers a robust solution. This use case covers everything from card creation and distribution to secure payment processing. With the flexibility to integrate with major card networks like Visa and Mastercard, Pismo ensures seamless transactions, enhanced security features, and compliance with global standards. Additionally, Pismo supports the creation of contactless cards and tokenization for increased consumer convenience and security.

Fintech Startups

Pismo’s platform is a great choice for fintech startups wanting to build and scale innovative financial products quickly. Whether it’s offering a digital wallet, a lending service, or a peer-to-peer payment platform, Pismo’s flexible API-first structure allows fintech companies to create tailored solutions. Startups can leverage its built-in compliance and security features to ensure regulatory adherence while accelerating their time to market.

Digital Wallet and Mobile Payment Systems

Pismo supports the creation of customizable digital wallets, making it a key solution for businesses that want to offer mobile payment systems. These wallets can integrate with popular services like Google Pay and Apple Pay, supporting QR code and NFC-based transactions. Additionally, businesses can leverage features like tokenization and P2P transfers to cater to modern consumer payment preferences.

E-commerce and Marketplace Integration

For online marketplaces, e-commerce platforms, and payment facilitators, Pismo provides an all-encompassing solution for handling seller payments, commissions, and financial settlements. With features like flexible payment schedules, split payments, and customizable fees, Pismo helps these platforms manage complex financial operations with ease. Whether it’s managing global transactions or offering localized payment methods, Pismo simplifies marketplace financial operations.

Digital Lending and Loan Management

Pismo enables the development and management of digital lending products, which is perfect for businesses that want to offer online loans. Its robust loan origination system can manage everything from loan applications to disbursements and repayments. With its scalable infrastructure, businesses can quickly scale their lending products to meet increasing customer demand, while ensuring regulatory compliance and risk management.

Cross-Border Payments and Multi-Currency Support

For businesses operating across multiple countries or currencies, Pismo provides a seamless solution for managing cross-border payments. The platform supports multi-currency operations, making it ideal for companies that need to facilitate international transactions. Whether it’s managing foreign exchange or ensuring compliance with local regulations, Pismo simplifies global financial operations for businesses of all sizes.

Financial Institutions’ Compliance and Security Needs

For banks and financial institutions that need to comply with stringent industry standards like PCI-DSS, SOC II, and ISO 27001, Pismo’s built-in security infrastructure provides a robust, compliant environment for sensitive data processing. Its high-availability features and real-time monitoring ensure continuous operations with zero downtime, making it an ideal choice for institutions that must meet rigorous security and regulatory requirements.

Deal Terms & Conditions

The deal terms and conditions for Pismo are typically outlined in a formal agreement between Pismo and its clients, tailored to the specific services and solutions provided. However, a general overview of the common terms and conditions that apply when using Pismo’s platform is as follows:

1. Subscription and Licensing

Pismo operates on a subscription-based model for its services. Clients are granted a license to use the platform based on the terms agreed upon during the contract negotiations. This license is typically non-transferable, non-exclusive, and limited to the scope of services outlined in the agreement. The duration of the subscription and renewal terms will be specified, with pricing based on factors such as the number of users, volume of transactions, and additional features requested.

2. Payment Terms

Clients are required to pay subscription fees in accordance with the agreed payment schedule, which may be annual, quarterly, or monthly. Payment methods are usually outlined in the contract and may include credit cards, bank transfers, or other approved payment options. Late payments may incur penalties, and Pismo reserves the right to suspend or terminate services if payments are not received within a specified grace period.

3. Service Availability and Support

Pismo provides a cloud-based platform with a commitment to uptime and availability. The service level agreement (SLA) typically outlines the expected uptime percentage, maintenance windows, and response times for technical support. Pismo guarantees 24/7 support through multiple communication channels, including phone, email, and online chat. However, clients are expected to use the platform in compliance with Pismo’s usage guidelines and not overload or misuse the system.

4. Data Security and Compliance

Pismo takes data privacy and security seriously, offering services in compliance with industry standards such as PCI-DSS, SOC II, and ISO 27001. The terms and conditions usually specify how client data will be handled, stored, and protected. Both parties agree to adhere to applicable data protection laws, including GDPR and other privacy regulations, when processing and storing personal or financial data.

5. Confidentiality and Intellectual Property

Both parties agree to maintain confidentiality regarding proprietary information shared during the course of the relationship. Pismo retains ownership of its platform, intellectual property, and any software updates or features developed during the engagement. Clients retain ownership of their data and content but agree not to reverse engineer, decompile, or copy the platform or any proprietary components.

6. Termination and Renewal

Either party can terminate the agreement if the other party breaches the terms and fails to rectify the breach within a specified period. Clients may cancel their subscription at any time, subject to the cancellation policy, which may require advance notice. Upon termination, clients are usually required to cease using the platform, and Pismo may delete or return the client’s data within a specified timeframe. Renewal terms and the process for extending the contract will be agreed upon before the end of the initial subscription period.

7. Limitation of Liability

Pismo’s liability for any damages arising from the use of the platform is typically limited to the amount paid by the client for the service over a certain period. Pismo is not liable for indirect, incidental, or consequential damages resulting from system downtime, security breaches, or other operational issues. Clients are responsible for their own backup systems and ensuring the security of their data.

8. Indemnification

Clients agree to indemnify and hold Pismo harmless against any claims, losses, or damages arising from the client’s use of the platform, including but not limited to issues related to data security, intellectual property infringement, or non-compliance with relevant regulations.

9. Amendments and Modifications

Any amendments or modifications to the agreement must be made in writing and signed by both parties. Pismo may update its terms and conditions periodically, with changes becoming effective after proper notification to the client. Clients may be required to accept the new terms to continue using the services.

10. Governing Law and Dispute Resolution

The agreement is typically governed by the laws of the jurisdiction where Pismo is incorporated or where the services are provided. In the event of a dispute, both parties agree to resolve matters through arbitration or other alternative dispute resolution methods, as specified in the contract.

Pismo offers two lifetime access plans:

Tier 1: $59 for 5,000 AI requests per month, access to the iOS mobile app (beta), and the ability to create custom prompts.

Tier 2: $159 for unlimited AI requests per month, all features of Tier 1, and priority support.

Both plans come with a 60-day money-back guarantee.

Is Pismo a one-time purchase or a subscription?

Pismo is available as a one-time purchase, offering lifetime access to the selected plan.

Key Features:

Multi-Platform Integration:

Pismo operates seamlessly across Mac, Windows, and iOS platforms, allowing users to access its features system-wide in any application.

Customizable Shortcuts:

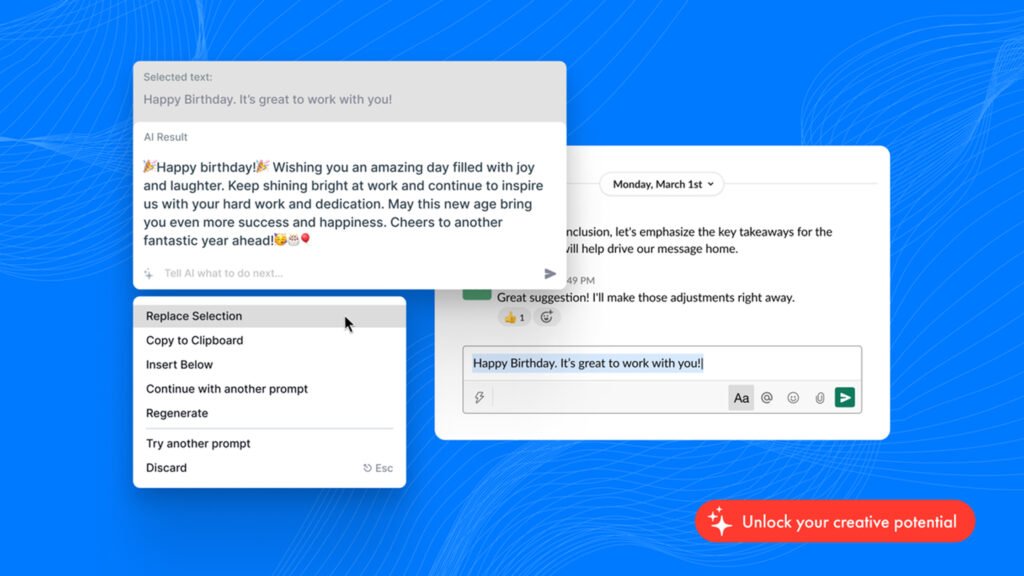

Users can create custom prompts and utilize hotkeys for quick access to AI assistance, streamlining the writing process.

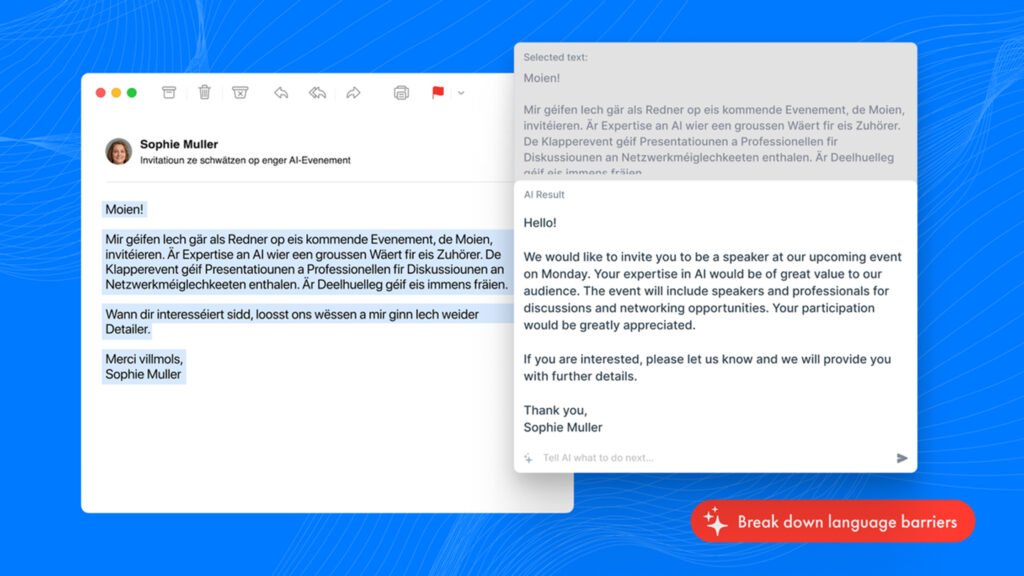

Translation Capabilities:

The tool supports multilingual writing and translation, making it suitable for users working in diverse linguistic contexts.

Mobile Access:

An iOS mobile app (currently in beta) is available, providing flexibility for users to utilize Pismo on the go.

From The Founders

Pismo was born from a group of expats in Luxembourg who grew tired of the endless cycle of copying, pasting, and rewriting text across different languages. To solve this, they built a lightweight AI assistant that streamlines prompt-based writing—without ever leaving the app you’re working in.

With custom prompt shortcuts and intuitive hotkeys, Pismo integrates effortlessly into any platform. Users can proofread, expand, condense, or translate content instantly, minimizing interruptions and maximizing productivity.

By combining multi-language intelligence with seamless automation, Pismo helps creators, marketers, and business professionals communicate clearly and stay focused on what truly matters—their work.

FAQ’s

1. How does Pismo work?

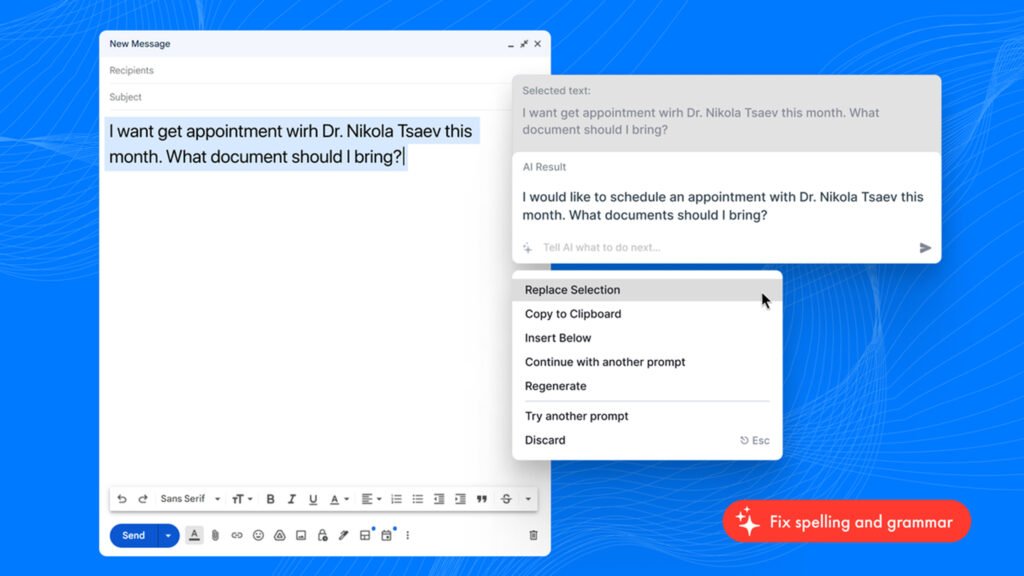

Pismo operates through on-screen prompts and hotkeys. You simply select the text you want to modify, press a designated shortcut, and choose a transformation such as “rewrite,” “summarize,” “proofread,” or “translate.” The AI instantly refines your text in place, saving you time and effort.

2. What makes Pismo different from other AI writing tools?

Unlike most AI tools that require browser access or online dashboards, Pismo works natively inside your existing apps—emails, documents, chats, and more. Its customizable prompt system and fast keyboard shortcuts make it far more efficient for everyday tasks.

3. Who can benefit from using Pismo?

Writers, marketers, students, professionals, and multilingual teams can all benefit from Pismo. It’s ideal for anyone who regularly needs to improve text quality, adjust tone, or translate content quickly while staying focused on their work.

4. Does Pismo require an internet connection?

Yes, Pismo needs an internet connection to access its AI processing capabilities. However, all text handling is designed to be secure and privacy-friendly, ensuring your data is protected during use.

5. Can I customize how Pismo responds?

Absolutely. Users can create and save custom prompts to tailor Pismo’s behavior to specific needs—like drafting emails, generating marketing copy, or simplifying technical content. This makes it flexible for both personal and professional workflows.

6. On which platforms is Pismo available?

Pismo is currently available for desktop environments and integrates with most text-based applications. Its lightweight interface ensures smooth performance without slowing down your system.

7. Is there a free trial or AppSumo lifetime deal?

Yes, Pismo offers a deal on AppSumo, providing lifetime access at a discounted rate compared to regular subscription plans. This makes it an affordable option for users seeking long-term productivity gains.

See what customers are saying

Explore Our Pages: WP Themes, WP Plugins